Here’s who will move forward in the Bradley replacement competition

By Jen Judson

Jun 26, 05:37 PM

The Army is moving into a detailed design phase as part of its effort to replace the Bradley infantry fighting vehicle with an Optionally Manned Fighting Vehicle by fiscal 2030. (Oz Suguitan/U.S. Transportation Command via AP)

WASHINGTON — American Rheinmetall Vehicles and General Dynamics Land Systems will continue on in the U.S. Army’s pursuit of an Optionally Manned Fighting Vehicle to replace the Bradley infantry fighting vehicle, the Army said Monday.

The service has renamed the envisioned platform the XM30 Mechanized Infantry Combat Vehicle.

Each team is expected to develop detailed designs over the next two years, followed by a competitive prototyping phase beginning in the first quarter of fiscal 2025, during which the teams will build a minimum of seven prototype vehicles with an option to build four more.

The Army said the total value of both contracts is approximately $1.6 billion; the overall program is expected to be worth about $45 billion.

BAE Systems, Oshkosh Defense and Point Blank Enterprises said they submitted bids, but were not selected by the Army to continue.

Those teams all participated in a 12-month preliminary design phase that produced concepts for how each would design a new vehicle if selected. The two teams now moving into the detailed design phase were also a part of that preliminary design phase.

The Army released a request for proposals to industry in the summer of 2022, and bids were due in November.

The plan was to choose three teams to move into the detailed design and prototyping phases of the competition, but Doug Bush, the service’s acquisition chief, said the Army wanted to ensure it had enough resources to keep the program on solid footing while ensuring competition all the way to a production decision.

“The original plan focused on maintaining competition as long as possible,” Bush said at a June 26 press briefing. “We’re still doing that. We’re just doing it with two instead of three for these two phases.

“We now have information we didn’t have before, including the bids themselves, which informed us about the overall resources required by the program,” he continued. “Finally we want to make sure, based on what we’ve learned over the years doing programs, that we have two fully resourced and standing-on-firm-ground companies going forward to do the [engineering and manufacturing development] work here.”

American Rheinmetall Defense’s team includes Textron Systems, RTX, L3Harris Technologies and Allison Transmission as well as artificial intelligence-focused company Anduril Technologies. All together they are known as Team Lynx, a nod to Rheinmetall’s vehicle that was the company’s planned original bid sample in the Army’s earlier attempt to hold a competition.

That competitive effort ended in the fall of 2019 when only General Dynamics Land Systems was able to deliver a physical bid sample to the Army by deadline. Rheinmetall, based in Germany, ran into issues delivering the Lynx and had to drop out of the competition.

With only one bid sample, the Army decided to scrap the competition. The service reworked its strategy in a lengthier, five-phase effort that began with the initial design phase in 2021 and is now moving into the detailed design phase, followed by the prototyping phase. Testing and production will be the final phases of the competition.

Now American Rheinmetall and GDLS will have another chance to face off for a chance to build the Bradley’s replacement. The service plans to award a contract in FY27 to one team, with fielding beginning in FY29.

GDLS is teamed up with GM Defense; Applied Intuition, a specialist in modeling and simulating autonomy for the automobile industry; and AeroVironment, which is providing its Switchblade loitering munitions for integration into the design. GDLS also continues to work with General Dynamics Mission Systems to incorporate networks, radio gear and cyber capabilities.

Matt Warnick, American Rheinmetall’s managing director, told Defense News the company, with its teammates “will deliver a vehicle with the most modern protection, firepower, mobility, and power generation capabilities available.”

Gordon Stein, vice president and general manager of U.S. operations at GDLS, told Defense News in a statement that his company’s “highly affordable OMFV development approach maximizes performance to the Army’s requirements, and delivers a vehicle that is purpose-built for the mission.”

BAE Systems decided not to participate in the previous competitive effort, but the Army chose it for the first phase of the new competitive effort. The company’s team included Elbit Systems, QinetiQ and Curtiss-Wright.

Oshkosh Defense partnered with South Korean defense company Hanwha, which provided the chassis design based on its Redback infantry fighting vehicle. Rafael Advanced Defense Systems, QinetiQ and Plasan provided to Oshkosh technology from turrets to armor to autonomy, as well as command-and-control capabilities. And Pratt Miller, which Oshkosh bought in 2021, was also a teammate.

Point Blank submitted a bid for the detailed design phase without its teammate Keshik, after they ended their partnership for the OMFV competition. Point Blank successfully sued Keshik, leaving the latter unable to compete separately or with another team.

Because Point Blank could not use Keshik’s technology and concept designs going forward, it brought in RENK America to provide a powertrain solution. RENK, a German company, opened up shop in Muskegon, Michigan, in 2021 to build advanced mobility systems.

Point Blank also swapped out turret manufacturer John Cockerill with Kongsberg Defence and Aerospace. Palantir, a data analytics specialist supplying the Army with its Distributed Common Ground System, was also a Point Blank teammate.

The Army hasn’t fully cemented its requirements, but is seeking a hybrid vehicle featuring a suite of lethal capabilities to include a 50mm cannon, a remote turret, anti-tank guided missiles, machine guns employed through an advanced third-generation forward-looking infrared sensor and “intelligent fire control,” Brig Gen. Geoff Norman told reporters during the press briefing.

The new vehicle allows for a two-person crew with six seats for infantry troops. The vehicle and its passengers will be protected by integrated active protection systems, kitted armor and “innovative signature management capabilities from the very beginning,” Norman said.

Bush noted “the modular, open-system architecture [on the] XM30 will allow new, developing technology to be added to the vehicle if that technology matures.”

About Jen Judson

Jen Judson is an award-winning journalist covering land warfare for Defense News. She has also worked for Politico and Inside Defense. She holds a Master of Science degree in journalism from Boston University and a Bachelor of Arts degree from Kenyon College.

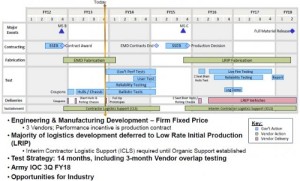

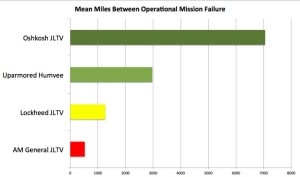

In the recent JLTV bid there were some test results that were shared by the Test Director:

Reliability of JLTV contenders and current uparmored Humvee (DOT&E data)

MMBOMF has been a key parameter on military truck contracts for at least the last 35 years and one would believe that it will continue to be a key parameter in future procurements of military vehicles. The FMTV MMBOMF is somewhere over 10,000 miles which is something like 4 times better than its predecessor vehicle (M909-M809-M-35 series).

|

||||

|

Report hints at Oshkosh Corp. award process

USA TODAY NETWORK-Wisconsin 1:38 p.m. CST February 10, 2016

Though most papers surrounding Oshkosh Corp.’s JLTV win are sealed in a suit, Pentagon report offers glimpse

While a challenge over the U.S. Military’s call in August to grant Oshkosh Corp. a multi-billion contract continues, a Pentagon report last week hints how companies vying for that award fared during testing.

The Pentagon’s chief weapons tester released his annual report reviewing the Joint Light Tactical Vehicle, or JLTV, program. Contract contenders Oshkosh Corp. and Lockheed Martin Corp. met force protection requirements, while Indiana’s AM General – known for building the iconic Humvee which JLTV would, in part, replace – did not.

Lockheed and Oshkosh Corp. are now locked in a lawsuit in the U.S. Court of Federal Claims, and much of those filings are sealed from the public. This report, authored by J. Michael Gilmore, the director of the Pentagon’s Operations Test & Evaluation Office, offers a glimpse into how each company’s JLTV prototypes performed in a Limited User Test, or LUT, which evaluates how these vehicles would operate.

Oshkosh and Lockheed prototypes “met all threshold force protection requirements and some objective-level requirements,” Gilmore wrote in the report.

JLTV protection exceeds Humvees with added armor, and mirrors Mine-Resistant Ambush-Protected All-Terrain Vehicles, or M-ATVs, “without the underbody improvement kit across all spectrum of tested threats,” he wrote.

Oshkosh Corp. rolled its skills building M-ATVs into its JLTV model, while Lockheed’s prototype scored protection marks in step with M-ATVs, according to the report.

But AM General’s model would need “significant redesign,” to square with protection requirements, Gilmore wrote.

Oshkosh Corp.’s JLTV outpaced both Lockheed and AM General in reliability tests, logging 7,051 “Mean Miles between Operational Failure,” compared to the Humvee’s 2,968 miles. Lockheed posted 1,271 miles, while AM General demonstrated 526 miles – both performing worse than the Humvee.

In further tests, platoons equipped with Oshkosh Corp.’s JLTV finished 15 of 24 missions similar to the team outfitted with Humvees. Lockheed finished 12 of 24 missions, while AM General completed 13 of 24 missions, according to the report.

Most failed missions were because of combat losses for Oshkosh and Lockheed JLTVs, while Humvee and AM General platoons suffered fewer losses against the “opposing force,” Gilmore wrote.

But AM General suffered “reliability failures” on nine missions, according to the report.

Gilmore recommended the Army develop a plan to address recommendations he filed in a classified report before production begins.

Under the Army contract, Oshkosh Corp. would build 17,000 JLTVs over the next nine years, though future renewal contracts could mean the company would net more than $30 billion over the next 25 years.

With the Department of Defense spending shrinking, competition for military contracts has tightened in recent years. While the number of contract protests filed with the Government Accountability Office rose 5 percent in the 2014 fiscal year, successful protests fell from 17 to 13 percent.

Lockheed is the largest American defense contractor, and Oshkosh Corp. is the 48th-largest, according to a 2015 Defense News ranking of top 100 contractors.

The GAO dismissed Lockheed’s challenge Dec. 15, on word that the company would mount a federal court challenge. The company claims the agency didn’t consider a trove of documents during its contract-award review.

That move lifted a 100-day, stop-work order on the JLTV contract and Oshkosh Corp. resumed production, though Lockheed has filed a motion to compel Oshkosh to halt work while the court decides if the contract was awarded correctly. By launching that suit, Lockheed is embarking on a more formal legal process; the GAO can only recommend changes, not mandate them.

Lockheed in its motion to halt work argued that the military applied different standards to the two companies when evaluating the contract and held “misleading” meetings with the company about the bid.

Lockheed is suing the government, while Oshkosh Corp. has joined the lawsuit, opposing the stop-work motion. A federal claims judge is expected to issue a decision on the stop-work request in mid-February.

Lockheed Martin Still Wants to Build the Army’s Next Humvee

Here’s why they’ll lose.

INTRODUCING THE U.S. ARMY’S NEXT TOP HUMVEE, THE JOINT LIGHT TACTICAL VEHICLE. IMAGE SOURCE: OSHKOSH.

Two weeks ago, Wisconsin-based truckmaker Oshkosh (NYSE:OSK) won a great victory. After eight years of debating a replacement for its venerable Humvee all-purpose jeep, the U.S. Army finally awarded a contract to build the darn thing — and Oshkosh won that contract.

Over the next eight years, Oshkosh will churn out a total of 17,000 Joint Light Tactical Vehicles for the U.S. Army and Marine Corps. If all goes well, the contract will then expand threefold. Oshkosh will ramp up and ultimately build a total of 55,000 of these JLTV armored trucks, earning an estimated $21.7 billion in total on the contract.

It would build these trucks, and earn this money, unless that is, Lockheed Martin (NYSE:LMT)has something to say about it.

Over our dead body

Unfortunately, Lockheed Martin does have something to say about it. And what Lockheed said last week was the equivalent of: “Your Honor, I object!”

LOCKHEED MARTIN THINKS THE ARMY MADE A BIG MISTAKE IN NOT PICKING ITS JLTV CANDIDATE. IMAGE SOURCE: LOCKHEED MARTIN.

On Sept. 8, Lockheed Martin filed an official protest against the Pentagon awarding Oshkosh the JLTV contract. Insisting that its own version of the JLTV is “the most capable and affordable solution for the program,” Lockheed is demanding that the U.S. Government Accountability Office (GAO) “address our concerns regarding the evaluation of Lockheed Martin’s offer.”

Curiously, the other loser in the Pentagon’s JLTV decision — AM General, which builds the Humvee that JLTV is meant to improve upon — chose not to file a protest.

Definition of an honest defense contractor: Once bought, they stay bought?

Why not? Well, here’s one possible explanation: Since the Pentagon tapped Oshkosh to build the JLTV, it has awarded AM General not one, not two, but three separate Humvee contracts! Together, the three awards to build Humvees for the Iraqi and Tunisian armies, and for the U.S. Army, Reserve, and National Guard units, are worth just shy of $450 million to AM General.

Sure, $450 million is not $21 billion. But it’s a whole lot more than nothing. It is also, apparently, enough to convince AM General not to rock the boat. The more so because, as AM General pointed out recently, there are still 230,000 Humvees in operation worldwide, 160,000 of which are with U.S. armed forces. Even if 55,000 of these ultimately get replaced by JLTVs, that’s still anywhere from 105,000 to 175,000 Humvees left for AM General to maintain, service, and sell spare parts for. It’s a big chunk of business, and not one AM General wants to endanger by irking the Army with a challenge to the JLTV.

When you’ve got nothing, you’ve got nothing to lose

Lockheed Martin, in contrast, has no such installed base of Humvee business at risk — and Lockheed got no JLTV consolation prizes from the Army. As one colorful commentator recently put it: “If they piss off the Army it just doesn’t matter” to Lockheed.

That would seem to give Lockheed Martin every incentive to rock the boat, and try to shake loose some JLTV dollars for itself. But Lockheed Martin may be taking a risk in doing so.

Enemies in high places

You see, GAO protests of defense contract losses really took off in the face of defense budget cutbacks back in 2009. The Pentagon wasn’t pleased with how this slowed down the process of getting vital equipment to troops in the field, however. Then-Pentagon acquisitions chiefAshton Carter even issued contractors a stern warning: They should only file protests of Pentagon contract decisions on “rare” occasions, and never “frivolously.”

Contractors who ignored this mandate risked incurring the Pentagon’s wrath.

Today, Carter is no longer just acquisitions chief: He’s been promoted to Secretary of Defense. And as such, he runs the whole (literal) shooting match. He’s in a position to, for example, punish a recalcitrant Lockheed Martin not just by denying it Army contracts, but by cutting funds for Lockheed’s all-important Air Force F-35 contract as well.

What happens next

Be that as it may, Lockheed’s die is now cast. GAO now has 100 days from the date of the protest (so until Dec. 17) to rule on Lockheed’s protest. If it decides the Army made a bad call, GAO will likely order it to reconsider Lockheed’s bid (and potentially AM General’s as well). Such reconsideration will add even more time to the process, and delay delivery of vital war matériel to the troops for additional months.

For its part, Oshkosh must now cool its heels and await the outcome of the protest. The Army has instructed it to stop work on the new trucks until the protest process plays out.

How will it play out? According to The Wall Street Journal, the GAO received more than 2,500 protests last year, most involving defense contracts. Fewer than a fifth of them succeeded. So statistically speaking, the odds favor Oshkosh, and disfavor Lockheed Martin. Meanwhile, with Oshkosh on the ropes financially, but essential to the Army as the company that maintains its MRAPs and builds its “family of medium tactical vehicles” and heavy trucks, the Pentagon has a strong incentive to stick to its guns and insist on giving Oshkosh this contract — and these revenues — as a financial lifeline.

By my count, that’s two arguments in favor of Oshkosh winning. Unless Lockheed Martin has the merits of this case clearly on its side, I suspect they’re bound to lose this battle.

The next billion-dollar iSecret

The world’s biggest tech company forgot to show you something at its recent event, but a few Wall Street analysts and the Fool didn’t miss a beat: There’s a small company that’s powering their brand-new gadgets and the coming revolution in technology. And we think its stock price has nearly unlimited room to run for early in-the-know investors! To be one of them, just click here.

AM GENERAL’S JLTV CANDIDATE LOOKED A LOT LIKE LOCKHEED’S. BUT UNLIKE LOCKHEED, AM GENERAL DOESN’T SEEM TOO UPSET THAT IT LOST THE JLTV CONTRACT. IMAGE SOURCE: AM GENERAL.

______________________________________________________________________

Drive to replace Humvee poses big test for Army

For the companies lining up to build the Humvee’s replacement, the stakes are high.

For the companies lining up to build as many as 50,000 new vehicles to replace the Army’s Humvee — the ubiquitous symbol of America’s recent ground wars — the stakes are high.

For AM General, the contract award could determine if it remains the main provider of U.S. Army transport vehicles. Oshkosh Defense’ fortunes may very well depend on landing the contract. And if Lockheed Martin wins, it would mean gaining a rare foothold into a new military market.

But also on the line in the Joint Light Tactical Vehicle is the credibility of the Army, which has failed to successfully carry out number of ground vehicle programs in recent years due to a combination of delays, cost overruns and performance problems.

The JTLV program, set to cost as much as $40 billion over the coming decades, is a chance for the Army to prove that it’s fixed the kinks in its acquisition pipeline and can actually field a troop carrier as advertised, say government and industry experts.

The service’s recent record of multi-billion dollar management failures is widely known: A self-propelled howitzer, known as the Crusader, was terminated in 2002; the Future Combat System, intended to be a family of light tanks, was killed in 2009; and its replacement, the Ground Combat Vehicle, was shelved last year after it, too, foundered.

“The Army’s acquisition track record over the last decade has been atrocious,” said Loren Thompson, a defense consultant with Source Associates. “So if it can’t develop a next-generation Jeep, people will wonder what it can develop.”

The Army made the JLTV, a lightly-armed wheeled vehicle as opposed to a tracked one akin to a tank, a priority when it shuttered the GCV program – and Army Chief of Staff Gen. Ray Odierno recently reiterated the importance of the program,“When we look at vehicles, we look at a family and what do we need? And this one we absolutely need,” he said at a Defense Writers Group breakfast event May 28. “I feel really good about what we’ve done with the JLTV. I think the way we’ve developed the requirements, the way it’s moving forward — it’s a really important step for us. … It will be a central piece of the Army as we go forward.”The production contract is expected to be announced this summer.

The timeline to begin equipping units is tight. The Army is set to choose by August between prototypes built by Humvee-maker AM General in Indiana, Oshkosh Defense in Wisconsin, and defense giant Lockheed Martin. And it plans to build 17,000 of the vehicles for the Army and Marines in three years, according to a recent analysis of the program by the Congressional Research Service, the research arm of Congress.

Nearly $460 million is being requested for the program in the Pentagon’s budget request now pending on Capitol Hill and $4.8 billion is budgeted over the next five years.

The trio of contractors eyeing the program, whose prototypes have undergone Army testing since 2013, have all launched ad campaigns aimed at key decision makers and enlisted former lawmakers, Capitol Hill staffers, and retired generals to help them win — and perhaps to apply some political muscle if they lose.

AM General, the manufacturer of the Humvee, has on retainer former Rep. Jim Saxton, a New Jersey Republican who served on the Armed Services Committee. Saxton’s former chief of staff, Elise Aronson, is also lobbying on tactical wheeled vehicles in her capacity as vice president of government affairs at McAndrews & Forbes, AM General’s parent company, according to lobby disclosure records.

Saxton said in a brief telephone interview that the work will pick up after the contract is awarded. “If they win the contract for JLTV, they’ll put me back to work,” he said.

Also working for AM General on light tactical wheeled vehicles, public records show, is a pair of former appropriations staffers, including Doug Gregory, who was a senior aide to the late Appropriations Committee chair Rep. C.W. “Bill” Young (R-Fla.), and Tom Quinn, former legislative director for Rep. Peter Visclosky of Indiana, who is currently the ranking Democrat on the Defense Appropriations Subcommittee.

AM General is an incumbent of sorts in the new competition and plans to build the JLTV in the same Indiana factory that it currently builds the Humvee, about 15 miles east of South Bend.

“We’ve been building light tactical vehicles for the Department of Defense for more than 50 years,” said Christopher Vanslager, vice president of business development and program management at AM General. “We’re ready, right now, fully tooled in Mishawaka, Indiana, to start production today.”

Oshkosh has been advertising through standard channels and going to trade shows to make its case, but the company’s actual strategy to win the contract has more to do with price. Oshkosh has been touting its affordability to try to make the case its bid is the wisest choice for the Army.

“With the Oshkosh JLTV, we’re providing the warfighter with the absolute best protected mobility, while providing the taxpayer and the U.S. government a great price,” said John Bryant, the company’s senior vice president of defense programs at Oshkosh and a retired Marine Colonel colonel. “That’s the simple strategy, the best protected mobility for the dollar. We’re ruthlessly focused on that.”

Bryant insists there are plenty of other revenue-producing options for Oshkosh if the company doesn’t win the contract – especially in international sales of JLTV and in its existing vehicle contracts. But John Urias, president of Oshkosh Defense, summed it up in October 2014: “If we don’t win, obviously that would be a hit.”

Lockheed Martin, too, is pulling out all the stops to prove that it doesn’t only build airplanes like its F-35 Joint Strike Fighter. But the defense giant has been stuck playing defense since its original plan — to build the vehicles at partner BAE Systems’ production facility in Sealy, Texas — was upended with the closing of the factory in 2013.

In a slick 30-minute webinar last week, Lockheed Martin showed off its JTLV production facility in Camden, Arkansas, where workers in jumpsuits hovered over factory equipment and climbed into the front seat of the company’s camel-colored JLTV.

Lockheed, which is trying to move past the Sealy plan closure, is touting its technological capabilities and universe of partner companies and suppliers.

“We think this actually fits what we do,” said Scott Greene, Lockheed vice president of ground vehicles. “We’re a systems engineering company, and there are some interesting physics challenges to take a vehicle that has a 14,000-pound curb weight and give it the survivability capabilities of a vehicle that weighs 40 percent more than that.”

A ramped-up Lockheed presence in Arkansas is welcome news to the state’s lawmakers, who have already pledged $87 million for use in the Camden facility if Lockheed wins.Republican Rep. Bruce Westerman of Arkansas estimated that the JLTV contract could bring hundreds of jobs to the area.

A ramped-up Lockheed presence in Arkansas is welcome news to the state’s lawmakers, who have already pledged $87 million for use in the Camden facility if Lockheed wins.Republican Rep. Bruce Westerman of Arkansas estimated that the JLTV contract could bring hundreds of jobs to the area.

“It is our hope that the company’s securing of the JLTV contract would allow Lockheed to not only maintain their presence, but grow it significantly,” Westerman said. “With the addition of a manufacturing division of Lockheed focusing on the JLTV, our citizens can continue providing for our national defense.”

Among the lobbyists advocating on behalf of the Lockheed Martin bid is Josh Holly of Podesta Group, a former House Armed Services Committee staffer who is on retainer to BAE Systems to work on light tactical wheeled vehicle issues. Smaller players on the Lockheed Martin JTLV team have also been plying the lobbying corridors on the issue — including Meritor Defense, a vehicle component manufacturer that has worked on upgrades to the Humvee. Last fall, Meritor hired Andrew Buczek, a government policy adviser at the Washington consulting firm Dykema.

While the bidders’ efforts will soon be put to the test, so will the Army’s.

Struggling to respond to the changing needs of the troops, the service has already been forced to change the specifications for JLTV — including requiring the vehicles to have the same level of armor protection as the Mine-Resistant, Ambush-Protected All-Terrain Vehicle. More requirements changes could further complicate the cost and schedule.

What also remains unclear, according to CRS, is whether the bidders will be offering the government a so-called “technical data package” — or blueprint — for their vehicles, a step that could permit the Army to hold competitions for future quantities of the JTLV.

“The Army could use that data for future production runs, which could enhance competition and possibly result in better prices for the government,” according to the CRS report.

One defense expert monitoring the project who was not authorized to speak publicly said the Army really hasn’t designed and built a successful ground vehicle since the late 1990s. And before that not since the tanks and armored personnel carriers of the Cold War.

“The Army quite frankly has a very poor track record,” the defense expert said. “And they really haven’t had what I would consider any major [research] and eventually development and fielding successes since the Abrams, Stryker and Bradley.”

The JTLV program, which is supposed to be far less complicated, hasn’t been all smooth thus far, the expert added.

“It’s had its bumps in the road, but we’re actually at the end of the day going to start rolling something off an assembly line and start sending it to units,” the expert said. “So in a sense it’s somewhat symbolic that yes we can, from drawing board all the way to production line, actually develop and procure a vehicle. Now granted, the bar is kind of low because it’s a wheeled tactical vehicle. It’s not a combat vehicle or a fighting vehicle per se, but quite frankly it’s a good place to start.”

Jen Judson contributed to this report.

Lockheed Martin Rivals Ready To Compete For JLTV Project Despite Arkansas Efforts

Although Lockheed Martin has firm support for an $87 million financing package from the state of Arkansas, a Washington, D.C.-based defense budget expert said there is no reason to believe that the Bethesda, Md.-based defense contractor has an advantage over rivals in the high-stakes Joint Light Tactical Vehicle acquisition for 55,000 new tactical ground vehicles for the nation’s military.

“I really don’t have a good sense of who’s the leader,” said Ryan Crotty, deputy director for defense budget analysis at the Center for Strategic and International Studies. “It is definitely high profile, but the (JLTV) program directors have kept it on lockdown as to who’s the favorite, and there are three pretty strong candidates.”

Crotty, whose bipartisan Washington, D.C.-based think tank offers research on a wide range of U.S. policy issues at the nation’s capital, said he still believes that the Pentagon will make an announcement concerning the JLTV project in July, although some defense and ground vehicle contracts have been cut, put on hold or are on the chopping block because of automatic spending cuts that are part of the 2013 sequestration.

However, the JLTV project is seen as a high priority among Pentagon and congressional officials because it offers very a limited window to upgrade and modernize the military’s ground vehicle capacity, he said.

ARKANSAS BOND FINANCING PACKAGE ‘HIGHLY UNUSUAL’

Crotty also called the Arkansas financing package “highly unusual” in defense contracting circles, saying it will be interesting to watch and see if it sets a pattern of local and state governments offering taxpayer-backed incentives for a taxpayer-funded government project.

“I have not heard anything from the other two competitors (Oshkosh and AM General) doing anything similar, but I don’t know if it gives Lockheed an advantage because they already have a demonstrated history with the federal government for this kind of contract,” he said. “I certainly don’t know if it will help (Lockheed), but it can’t hurt.”

Crotty added that all of the companies are supported by local and state officials in the communities where they operate, but “this particular incentive (program) in Arkansas is not something that I have seen a lot of, and it remains to be seen if it sets some kind of precedent.”

Besides Lockheed Martin, publicly-traded Oshkosh Corp. in Wisconsin and privately held AM General LLC in South Bend, Ind., are the other two finalists to build the next-generation tactical, armored vehicle in a contract worth more than $30 billion through 2040.

In 2012, the U.S. Army and Marine Corps selected all three to build JLTV prototypes to replace the aging Humvee, which is noted for its off-road capabilities but is vulnerable to the road-side bombings that targeted U.S. troops during conflicts in Iraq and Afghanistan. Based on their recent applications, each company received a split of a $185 million award and started from scratch to develop their own version of the JLTV tactical vehicle.

In February, each company submitted final applications to the Army and Marine Corps that met the Pentagon draft requirements for a tactical vehicle that had the off-road capabilities of the Humvee, but also was capable of withstanding anti-vehicle explosive devices that would serve as an Internet-ready, technology command center on the battlefield.

Three other companies, BAE, General Dynamics and Navistar, also submitted proposals to the earlier request for proposals (RFPs) that began in 2008, but did not make the final cut that trimmed the competitors in half.

FINALISTS OFFER ADVANTAGES

Today, each company has dedicated websites for the JLTV vehicle, offering photos, videos and talking points on their version of the JLTV tactical vehicle. All of the prototypes have a similar look and body type, but each company offered Talk Business & Politics their own reasons why they best meet the Pentagon requirements for “a lightweight, highly-mobile, net-ready vehicle” with unprecedented levels of protection for U.S. troops on the modern battlefield.

Oshkosh spokeswoman Jennifer Christiansen said the reason why the Wisconsin defense contractor and truck builder should be selected to build the JLTV is very simple. “Experience,” she told Talk Business & Politics.

“Oshkosh Defense has decades of experience designing, manufacturing and sustaining the U.S. military’s heavy, medium and mine-resistant ambush protected all-terrain vehicle (M-ATV) fleets,” she said. “In developing our JLTV solution, we applied in-theater experience to develop the next generation light vehicle with unprecedented protection and off-road mobility for our troops.”

Christiansen, who is vice president of business development operations for Oshkosh, said the company’s workforce is highly trained and is already building vehicles for the U.S. military.

“This is an important consideration because transitioning a new vehicle like JLTV from the development phase into production can be very challenging for a company lacking vehicle production experience,” she said, not specifically naming Lockheed Martin. “This is where Oshkosh is truly unique because no other company has successfully transitioned more new military vehicle programs into production for the U.S. Department of Defense.”

And although the state of Wisconsin has been partnering and investing in military vehicle technology, manufacturing and infrastructure for years, “Oshkosh is not dependent on economic incentives or taxpayer funded bonds to build brand new capabilities to compete for JLTV,” Christensen said.

“At Oshkosh, our team with support from our suppliers, stands ready to add JLTV to our current production lines today,” Christensen said.

According to Oshkosh’s application submitted on Feb. 10 in response to the request for proposal (RFP) for the JLTV, the Wisconsin company said it is “fully prepared” to begin production of the all-terrain vehicles immediately. According to sources, the company’s bid was the lowest of the three finalists.

“Our troops deserve the best vehicle and technology our government can provide, and no other company serves this mission more effectively than Oshkosh,” said U.S. Army Major General (Retired) John Urias, executive vice president of Oshkosh Corp. and president of Oshkosh Defense. “Our JLTV proposal reflects Oshkosh’s heritage of building high performance tactical vehicles, and an unparalleled commitment to providing our troops with the most capable and reliable JLTV at an affordable price.”

HUMVEE MAKER AM GENERAL SAYS IT HAS MOST EXPERIENCE

AM General’s version of the JLTV, called the Blast Resistant Vehicle-Off-road (BRV-O) tactical vehicle, was also submitted to the Pentagon on Feb. 10. Company officials said that the BRV-O provides the most operational and protection capability to address current and future needs of the U.S. Army and Marine Corps.

“The BRV-O is a combat system designed and built with a total focus on Warfighter needs, by a team whose sole calling is fielding the world’s best light tactical vehicles. The BRV-O JLTV proposal reflects AM General’s dedication to excellence and our steadfast determination to be the most reliable, trusted partner for the United States government,” said AM General President and CEO Charlie Hall. “AM General has the experience, focus, innovation and investment to give soldiers and Marines the advantage in a dangerous and constantly changing world.”

AM General spokesman Jeff Adams told Talk Business & Politics that the Indiana defense contractor “is the leading ‘light tactical vehicle’ manufacturer in the world, supported by an expert workforce and our state-of-the-art, fully-tooled, production-ready facility.”

“Our Blast Resistant Vehicle-Offroad (BRV-O) is a transformative vehicle, with an agile and hardened system that will equip and support the Army and Marine Corps with tactical mobility, proven C4ISR and unsurpassed protection,” said Adams, executive director for the global communications and marketing at AM General. C4ISR is the military acronym for command, control, communications, computers, intelligence, surveillance and reconnaissance.

One dynamic that some JLTV watchers believe works both for and against AM General’s is the fact that the Indiana company is also the original designer and manufacturer of the HMMWV, or Humvee vehicles. Designed for garrison duty during the Cold War, it was not originally designed to be an armored vehicle to protect troops from mines and roadside bombs in recent Middle East conflicts.

Although the company has not received any specific incentive package for the JLTV project, Adams said the company is a trusted partner for the U.S military and “we are proud of our longstanding, productive partnership with the State of Indiana.”

THE CASE FOR LOCKHEED MARTIN

For Lockheed Martin, also a publicly traded company, JLTV observers say its key advantage is its position as the nation’s largest defense contractor and familiarity with the Pentagon contracting process. The defense contracting giant has also teamed with Boeing Co. to bid on a contract to build a new long-range bomber for the Air Force worth over $80 billion. Northrop Grumman Corp. is also competing for that contract, which is also expected to be announced later this summer.

At the State Capitol on Tuesday, Lockheed Martin officials offered a rare glimpse at their version of the JLTV prototype that has been kept under close wraps.

Lockheed Martin executives said the company plans to bolster the state’s $87.1 million bond financing with a total investment of more than $125 million for infrastructure improvements in Camden, as well as reach job-creation and wage milestones set by the state over the next 25 years.

Lockheed officials also said that the current estimate of 55,000 vehicles is a conservative estimate. They said that tally could easily increase depending on the needs of the U.S. Army and Marine Corps. Also, several U.S. allies have expressed interest in purchasing a version of the new JLTV vehicle, which would push orders well above the current purchase order.

The incentive package for Lockheed Martin is not the first of its kind. In fact, Camden is not even the first “Camden” to get multi-year, tax financing to land a Lockheed Martin project.

According to a story from November in The New Jersey Star Ledger, that state’s Economic Development Authority (EDA) approved a 10-year, $107 million tax break to Lockheed Martin as an incentive to move 250 employees from elsewhere in the state to a pair of new facilities to be established in Camden, N.J.

Under the incentive agreement approved by the EDA on Monday, Lockheed Martin must keep a minimum of 4,464 jobs in New Jersey in order to receive the full $107 million award over 10 years.

The Arkansas bond financing package that was passed by the Arkansas House and Senate on Wednesday would hand over nearly $83 million to Lockheed Martin for assistance in retaining its current 530-person workforce. Those funds will also be used to assist the company in expanding its current facility, and it will allow the Maryland-based defense giant to double its labor pool to handle the Pentagon’s award that will last through 2040.

The bond financing will also pay for an additional $1.6 million training grant to be used for construction and the equipping of training facilities at Southern Arkansas University Tech in Camden. The remaining $2.5 million will pay for expenses related to bond issuance costs, debt service reserves, and other eligible financing costs incurred or paid by the state, officials said.

If the project falls through or if Lockheed Martin is not awarded the project, the deal is dead and Arkansas is off the hook for the money, said Gov. Asa Hutchinson spokesman J.R. Davis. The payback of bonds for the state, which will be somewhere between 15 and 20 years, is dependent upon market conditions at that time.

To learn more about each’s company JLTV tactical vehicles, click here for Oshkosh, here for AM General and here for Lockheed Martin.

——————————————————–

Eastern Company: A Micro-Cap Play On JLTV

May. 6, 2015 9:19 AM ET | EML

Summary

Eastern Company sheds light on its role in the massive Joint Light Tactical Vehicle program proposed by the U.S. Army and Marine Corps.

The JLTV program may continue for over 20 years.

U.S. Military Specifies Eastern Company (NASDAQ:EML) as Supplier of Choice for JLTV Program

Eastern Company disclosed its unique standing in the Joint Light Tactical Vehicle program proposed by the Army and Marine Corps.

In recent years, working very closely with the U.S. military, we developed the latching and locking systems needed to meet the security and safety needs of our military during the Afghanistan and Iraq wars. Now, the Company is specified as the supplier of choice by the U.S. military for latching systems for the new Joint Light Tactical Vehicle (JLTV) when the program begins.

No matter which of the three general contractors wins, Eastern’s Eberhard Manufacuring Company is expected to be named as the sole supplier of advanced latching systems for JLTVs.

JLTV Status

Final bids were submitted by Oshkosh Defense, AM General, and Lockheed Martin on or before Feb. 10, 2015. The JLTV program is proposed to include 55,000 vehicles at an estimated cost of over $25 billion, the program is planned to end in the year 2040 and that the President’s Fiscal Year 2016 Budget Request is for $456.9 million. Also, importantly, the report by Congressional Research Service states:

The Army — on behalf of itself and the Marines — plans to select a winner and issue a single contract award in the late summer of 2015.

The JLTV program has been under active review and testing since the 2006-2008 period. There is a great deal of literature on JLTV designs including thisWikipedia description. And further, see the recent Military & Aerospace Electronics article by John Keller entitled “Military light vehicle market set to explode driven by JLTV program, says Forecast International”.

Here is info on JLTV contractor – AM GENERAL

————————————

BAE Systems wins deal for new armored vehicles

ARLINGTON, Va., Dec. 24 (UPI) — The U.S. Army has selected BAE Systems for its program to produce a replacement vehicle for Vietnam War-era M113 armored personnel carriers.

Under an award worth as much as $1.2 billion, BAE Systems is to engineer, manufacture and develop 29 low-rate production Armored Multi-Purpose Vehicles.

The contract features a 52-month base term worth $383 million and an option to begin the vehicles’ low-rate initial production phase for another 289 vehicles.

“This award represents a significant milestone for the U.S. Army and BAE Systems,” said Mark Signorelli, vice president and general manager of Combat Vehicles at BAE Systems. “The AMPV will provide a substantial upgrade over the Army’s current personnel carrier fleet, increasing the service’s survivability, force protection, and mobility while providing for future growth potential.

“It also confirms BAE Systems’ role as a leading provider of combat vehicles.”

BAE Systems said the 26 Engineering, Manufacturing, and Development phase vehicles to be produced will cover all planned AMPV variants, including mortar carrier, mission command, medical evacuation, medical treatment and general purpose.

BAE Systems said its AMPV leverages the design of the Bradley Fighting Vehicle and others to meet the Army’s force protection and all-terrain mobility requirements being able to maneuver with Armored Brigade Combat Teams.

Working as part of BAE Systems’ team for the vehicle are DRS Technologies, Northrop Grumman, Air Methods Corporation, and Red River Army Depot.

Work under the award will be conducted at company facilities in Pennsylvania and Michigan.

Wheels: 3-way showdown — Army’s Joint Light Tactical Vehicle prototypes testing begins

By David Vergun, ARNEWS

Full-pace, full-scope testing of the Joint Light Tactical Vehicle (JLTV) prototypes began Sept. 3 and will last for 14 months.

Three prototypes vying to be the U.S. military’s Joint Light Tactical Vehicle are undergoing testing. One will emerge as the winner. The AM General prototype is on the left, Oshkosh JLTV in the center, and the Lockheed Martin prototype is on the right.

Each of the three vendors — Oshkosh Defense (Light Combat Tactical All-Terrain Vehicle [L-ATV]), Lockheed Martin (JLTV), and AM General (Blast Resistant Vehicle – Off road [BRV-O]) — delivered 22 vehicles and six trailers for testing to three sites: Aberdeen Proving Ground, Md.; Yuma, Ariz.; and Redstone Arsenal, Ala.

Rigorous reliability testing over various terrains and in different weather conditions and protection-related testing is being conducted, said Col. John Cavedo, the Joint Program Office manager, who spoke Sept. 4 during a JLTV webcast.

Reliability, availability, and maintainability, called RAM testing, will determine the winner, Cavedo said. Additionally, input from Soldiers and Marines “will absolutely be taken very seriously.”

RAM testing includes evaluations of performance, protection, and payload. The vehicles will also be evaluated for transportability, mobility, expeditionary capability, network-readiness, and affordability.

While this marks the beginning of full-scale testing, a certain amount of testing has already been done, including more than 400 ballistic and blast tests on armor testing samples, underbody blast testing, and more than 1,000 miles in shakedown testing.

The program is still on track despite this year’s sequestration and continuing resolutions, but if budget issues are not resolved by next year, Cavedo said he could not rule out a slip in the schedule.

“We’re doing everything we can to keep the program on track,” he said, emphasizing the importance of the program to meeting asymmetrical threats like those experienced in Iraq and Afghanistan.

Closing the capabilites gap

Cavedo related an incident years ago at the Fulda Gap on the East-West German border.

“My company commander pointed to the northeast and told me, ‘That’s where the enemy will come from,’ and then turned around and said, ‘That’s the secure area in the rear where the friendly forces will be.'”

During Cold War-era exercises, Humvees safely moved about the rear area while tanks and other heavily armored vehicles would maneuver in the battle space. The Fulda Gap was considered by many to be the best line of approach for Soviet tanks moving west and south.

That notion of front lines and rear area was no longer applicable after 9/11, he said. Humvees became vulnerable to improvised explosive devices no matter where they were. Up-armor was added for protection, but the enemy adapted to that with more lethal explosives.

The added weight of the up-armor taxed the Humvees’ performance and further limited its payload, which now included network gear. And the Humvees were just getting old, with the first ones rolling off the assembly line about three decades ago.

Oshkosh Defense’s Joint Light Tactical Vehicle prototype negotiates the off-road demonstration course at the Transportation Demonstration Support Area in Quantico, Va.

Soldiers and Marines continued to be vulnerable, so the mine-resistant, ambush-protected vehicles, known as MRAPs, were developed. These had good payload and protection and helped save many lives over the last six years, but performance was sacrificed and Soldiers could not move with speed and agility around the battlefield, especially in the difficult terrain in parts of Afghanistan, he said.

Furthermore, the heavier versions of the earlier MRAPs could not be moved around the battlefield by helicopter. They required strategic lift, which in turn required adequate runways for these big cargo planes to take off and land.

The sustainment cost for the MRAP program increased over time, he said, as more variants were developed by different vendors. Parts were not interchangeable, and mechanics had to get follow-on training, he said.

The JLTV closed the capability gap, addressing “the iron triangle of payload, performance, and protection,” he said. Its payload and protection is similar to an MRAP, and its performance exceeds that of a Humvee.

Adaptability and flexibility

Besides addressing the “iron triangle,” Cavedo said the JLTV is designed to meet the needs of the commander for a variety of missions.

The commander can decide what level of protection JLTV needs for the mission, he said, pointing out that armor kits will be available for vehicles going into harm’s way. Also, some of the JLTVs will be equipped with heavy weapons, including TOW missile systems, while others can be used as light utility vehicles.

Other kits include command and control and network gear. He said JLTV plug-and-play, open-architecture technology allows for future networks and electronic devices to be installed without a vehicle redesign.

Lockheed Martin’s Joint Light Tactical Vehicle prototype negotiates the off-road demonstration course at the Transportation Demonstration Support Area in Quantico, Va.

While different vehicles will have different kits, all vehicles come equipped with automatic fire extinguishers, multiple egress options, fuel-tank fire-suppression systems, and combat locks. Exportable power is also a key feature, with 10 kW being the minimum requirement and the top potential being 75 kW.

Powering the 14,000-lb curb weight JLTV and whatever kits and trailers are added on is a 300-hp fuel-efficient diesel engine. JLTVs also will be able to tow the thousands of legacy trailers that are still usable.

“We expect to see a 10- to 15-percent improvement in fuel economy just by going to a modern fuel-injected, digitally controlled engine and have a curb weight that still meets Army and Marine Corps mobility requirements,” Cavedo explained. “The JLTV will be designed with enough on-board power to support the Army’s future network and be able to take advantage of the latest generation of diesel engine technology to maximize fuel economy.”

Lockheed Martin’s JLTV overview demonstrates the primary goals/features of the vehicle and program.[Image: Lockheed Martin]

The JLTV is being built as a single truck in two primary configurations: a four-door platform called the Combat Tactical Vehicle and a two-door platform called a Combat Support Vehicle; the four-door platform will include a heavy gun carrier and close-combat weapons carrier variants designed to carry weapons such as a .50-cal machine gun, TOW missile, and conduct mounted patrols and convoy escort missions, among other things. The Combat Tactical Vehicle will be able to carry 3,500-lb of payload.

All of the JLTVs will be configured with Variable Ride-Height Suspension, described as the ability to raise and lower the suspension to meet certain mission requirements such as the need to raise the suspension in high-threat areas and lower the suspension so that the vehicles can be transported by Maritime pre-position-force ships. Also, the JLTV will be able to sling-load beneath a CH-47 helicopter under standard conditions.

Holding costs down

“We’ve managed to hold costs down by promoting better competition between vendors, incentivizing productivity, and conducting an analysis of alternatives,” Cavedo said. By “analysis of alternatives,” he means ordering the right number of kits and mission packages. “We don’t want surplus kits stockpiled in warehouses across the country.”

Incentivizing productivity, he explained, means that after giving the original equipment manufacturer, or OEM, the specs (like protection, speed, weight, and so on), it is up to them to determine how it’s built and what the tradeoffs are.

Cavedo provided an example. Besides armor kits, the basic JLTV requires a certain level of protection. There might be very exotic metals out there that are lightweight and offer exceptional protection, but the cost involved would be astronomical. So a tradeoff might be reached where steel or aluminum is used to keep the cost down but still meet the basic requirements. To be competitive, however, the thickness or type of material used might exceed basic standards but be within a reasonable price range.

AM General’s Joint Light Tactical Vehicle prototype negotiates the off-road demonstration course at the Transportation Demonstration Support Area in Quantico, Va.

Tradeoffs like this apply to the power and transmission features and to everything else on the vehicle, he said. They’re trying to be as innovative and competitive as possible with the other OEMs, yet they must stay below the $250,000 assembly-line figure.

There are other ways cost has been controlled. Instead of requiring each OEM to supply 35 vehicles, they were required to provide 22 for the testing phase, he said. That number is reasonable and adequate for an effective evaluation.

Also, instead of a cost-plus type contract, the JLTV is on a firm-fixed price contract.

“In the past, the production price was set after down-select,” he said. Down-select is the final selection of a single OEM vendor. “Our intent was to set production prices during competition, so as we go forward into the competitive down-select we’ll have production prices set at that point and not negotiated for the years out.”

“All three vendors absolutely meet the key requirements; all could close that critical and substantial capability gap in our light tactical wheel portfolio,” Cavedo concluded. “In the end, the government will pick the very best of best. We’re in a fortunate situation.”

Timeline

Source-selection evaluation will start in early 2015 and conclude by July of that year, when a single vendor will be selected.

At that time, 2,000 vehicles will be produced and tested for three years with the focus on fine-tuning the assembly line, full-up system testing, and so on.

Full-scale production will begin in fiscal year 2018 with the ratio of organic to contract work determined by the third quarter of fiscal year 2015.

By 2018, the first Army brigade will roll with new JLTVs, Cavedo said.

JLTV program schedule.

Production will total 49,000 JLTVs for the Army and 5,500 for the Marines, with the production cycle ending sometime in the 2030s.

Kits will initially be produced by the selected OEM, but follow-on kits might use a different vendor, he said.

In conclusion, Cavedo said the JLTV comes at the right time at the right cost; is the perfect match to the Army’s shift to the Pacific, regional alignment strategy; and meets the requirements of the Defense Strategic Guidance of 2012 and the Army’s 2014 Equipment Modernization Plan.

————————————————–

BAE’s Army trucks sold for scrap metal?

SEALY, TX (KTRK) — After seeing expensive military trucks at a Sealy scrap yard, Eyewitness News and US Senator Ted Cruz are asking the same question: What will become of the $300 million worth of military trucks sitting outside a plant in Sealy and how many of them are destined for the scrap yard?

We started asking questions after Tommy Quinton, an Eyewitness News viewer, saw nearly a dozen of the $300,000 trucks sitting at Torres Metal Recycling in Sealy.

They were haphazardly hidden behind a tractor trailer and hard to see from the road, but plainly visible from our SkyEye HD helicopter. As we approached, it appeared a worker was climbing atop one of the MRAPs to cut it to pieces. They stopped work while we were overhead.

Later the Pentagon confirmed the 12 trucks we saw are battle damaged and not worth repairing. A spokesman said they will be scrapped for pennies on the dollar.

“Cut up?” Tommy Quinton told us, “It makes no sense. No sense at all.”

The trucks are what the military calls Mine-Resistant Ambush Protected vehicles. The trucks unique V-shaped bottom saved countless lives; the V-shape directed energy from an IED away from the troops inside.

The MRAPs were part of a $45 billion Pentagon program to rush thousands of these trucks into production as insurgents in Iraq and Afghanistan attacked our forces with roadside bombs.

It is a monster, monster truck — 18 tons of armor-plated protection America was willing to pay a hefty price for just a few years ago.

Now, the wars are winding down.

The Secretary of Defense’s office tells us, the US military is getting rid of 13,000 of the 24,000 mine resistant trucks made since 2007.

The ones we saw at the scrap yard are part of the ones the Pentagon is disposing of.

The plan is to offer the others to allies or domestic law-enforcement agencies free of charge, but thousands will still likely be scrapped. The Pentagon says it is just way the way programs like this are brought to an end. It is cheaper to dispose of them than maintain thousands of unneeded trucks.

But now what happens to the more than 1,000 MRAPs still sitting at the Sealy plant?

Scott Gossett who lives next door noticed the knee-high grass growing between the tires.

“It’s been 2,3, 4 months since I’ve seen one go out of there,” Gossett said.

BAE, the company that made the trucks says they don’t know nothing about them, that those trucks belong to the Army now. In other words, US taxpayers have paid for them.

It is more than $300 million worth of trucks without a certain future.

“It’s a shame,” Gossett told us. “A lot of people put a lot of work into those.”

The military doesn’t know or won’t say what the plan is for those trucks. But if they can’t give them away, they will be scrapped.

A vehicle that cost $300,000 to $500,000 when it was new will be sold by the pound to recyclers for roughly $3,500, one percent of its original value.

We’re not the only ones asking the Army what will becomes of the Texas made trucks now parked at that soon to be shuttered Sealy plant. When we found out about it, we asked Senator Ted Cruz, who sits on the Armed Services Committee, now he wants to know too.

——————————————

Lockheed Martin Manufacturing Readiness Assessment (MRA)

DALLAS, Dec. 11, 2013 /PRNewswire/ — The Lockheed Martin [NYSE: LMT] Joint Light Tactical Vehicle (JLTV) team successfully completed the government’s Manufacturing Readiness Assessment (MRA), an important milestone on the path to vehicle production at the company’s Camden, Ark., manufacturing complex.

The MRA, which measures manufacturing maturity and assesses technical risk, took place at Lockheed Martin’s Camden Operations on Nov. 18 and 19. In October, the company announced plans to produce the JLTV at the award-winning Camden facility, where program officials expect to gain significant production efficiencies and cost reductions.

“We look forward to adding another joint U.S. Army/Marine Corps vehicle-manufacturing program to our Camden Operations,” said Scott Greene, vice president of Ground Vehicles for Lockheed Martin Missiles and Fire Control. “With proven assembly methods, a keen focus on efficiency and a highly skilled workforce, we are confident that the tremendous success we’ve achieved producing the HIMARS launcher for the Army and Marines will translate to an outstanding JLTV for those very same customers.”

The Lockheed Martin JLTV is designed to replace many of the current Army and Marine Corps HMMWV “Humvee” vehicles, providing significant advances in survivability and capability.

Lockheed Martin’s Camden Operations has received more than 60 awards over the last decade, including the 2012 Malcolm Baldrige National Quality Award and the Shingo Silver Medallion Award for Operation Excellence.

The Lockheed Martin JLTV is systems-engineered to provide the crew protection of Mine Resistant Ambush Protected (MRAP) vehicles, while returning crucial mobility, reliability and transportability to Soldiers and Marines. A patented Meritor Pro-Tec(TM) all-independent air-ride suspension brings unprecedented agility and off-road mobility to this class of vehicles, while the dependable Cummins turbo diesel and Allison transmission combine abundant power with exceptional fuel efficiency. Rounding out the vehicle’s portfolio of capabilities are an exportable power-generation with substantial margin for future growth, and state-of-the art connectivity with other platforms.

For more than three decades, Lockheed Martin has applied its systems-integration expertise to a wide range of successful ground vehicles for U.S. and allied forces worldwide. The company’s products include the combat-proven Multiple Launch Rocket System (MLRS) M270-series and High Mobility Artillery Rocket System (HIMARS) mobile launchers, Havoc 8×8, Common Vehicle, Light Armored Vehicle-Command and Control, Warrior Capability Sustainment Programme, Joint Light Tactical Vehicle and pioneering unmanned platforms such as the Squad Mission Support System (SMSS).

Lockheed Martin Missiles and Fire Control is a 2012 recipient of the U.S. Department of Commerce’s Malcolm Baldrige National Quality Award for performance excellence. The Malcolm Baldrige Award represents the highest honor that can be awarded to American companies for their achievements in leadership, strategic planning, customer relations, measurement, analysis, workforce excellence, operations and results.

Headquartered in Bethesda, Md., Lockheed Martin is a global security and aerospace company that employs about 116,000 people worldwide and is principally engaged in the research, design, development, manufacture, integration, and sustainment of advanced technology systems, products, and services. The Corporation’s net sales for 2012 were $47.2 billion.

For additional information, visit our website:

http://www.lockheedmartin.com

SOURCE Lockheed Martin

/CONTACT: Craig Vanbebber, 972-603-1615; craig.vanbebber@lmco.com

/Web site: http://www.lockheedmartin.com

—————————————————-

Army’s Ultra Light Vehicle now in survivability testing

Two of the three vehicles in the Army’s “Ultra Light Vehicle” program have now entered survivability testing in Nevada and Maryland to evaluate both their blast and ballistic protection capability.

The third vehicle remains at the Army’s Tank Automotive Research, Development and Engineering Center for testing there.

Related Research on ASDReports.com:

Traction Batteries for Electric Vehicles Land, Water & Air 2013-2023

The TARDEC began development of three ULVs in fall 2011, at the request of the Office of the Secretary of Defense. While the ULV will not be fielded as a combat vehicle, it does serve as a research and development platform that will ultimately yield data that can be used by other TARDEC agencies and program managers, as well as sister services to develop their own vehicles and equipment in the future.

“It’s all about sharing the data,” said Mike Karaki, the ULV’s program manager. “If we have an ability to share the data internally within TARDEC, and externally within the program managers and program executive offices, and beyond that with other government agencies, we will attempt to do that. It’s helping shape and inform future programs.”

Karaki said the ULV program might help development of survivability in future vehicles, and may also help development of other hybrid vehicles as well.

“You want to be able to use anything and everything you can from this program to help reduce the duplication of efforts in the future,” he said.

The ULV is a hybrid vehicle that includes lightweight advanced material armor, lightweight wheels and tires and other automotive systems, blast-mitigating underbody technology and advanced C4ISR equipment inside.

“We tried to push the envelope in terms of state-of-the-art and out-of-the-box materials throughout the entire development process,” said Karaki.

The vehicle, from design to delivery, took only 16 months, Karaki said.

“We show there are some successes in the rapid design, development, fabrication and integration of the effort,” Karaki said. “It’s doable. It’s high risk and high reward. Can you do it in a rapid time frame? We’ve proven we can do that.”

The ULV is hybrid vehicle powered by a diesel engine that drives an electric generator. That generator in turn powers two electric motors that turn the wheels. Two electric motors provides redundancy should one of the motors fail.

Karaki said choosing a hybrid system came from the need to develop a more survivable vehicle for Soldiers. He said the contractor was concerned about how to make the vehicle perform better in a blast event, and came to the conclusion that a hybrid was the better choice.

Because it is a hybrid vehicle, it has none of the standard equipment underneath the vehicle. It features instead a “clean underbody” that makes it more capable of withstanding something like an explosion from an improvised explosive device.

“If you keep less equipment, accessories, systems underneath the vehicle, and you allow the underbody geometry to do what it needs to do — have a clean underbody — you will be able to improve your chances of being able to direct a blast away from the vehicle,” he said.

The primary customer for the ULV vehicle, which is a test vehicle, is the Office of the Secretary of Defense. The program came with four research objectives, which are a 4,500 pound payload, a vehicle weight of 14,000 pounds, protection that is comparable to the currently fielded mine resistant ambush protected vehicle, and a price of $250,000 each for a hypothetical 5,000-unit production run.

Karaki said the program is meeting or is expected to meet those objectives.

“On paper, the stuff upfront, the size, the weight, the cost, the timeframe, we checked those boxes,” he said. “The testing and evaluation of all these advanced survivability systems are in process right now.”

Two of three vehicles are undergoing survivability testing now. The third vehicle is in Warren, Mich., at TARDEC’s Ground Systems Power and Energy Laboratory undergoing automotive testing and to evaluate its hybrid electric setup. Karaki said eventually the two ULVs undergoing survivability testing will be destroyed as part of that testing. The third vehicle, the one at TARDEC, will be kept as a test platform.

The ULV is not a replacement for the Joint Light Tactical Vehicle program or the Humvee. It is an experimental vehicle used for testing purposes. The program will wrap up in fiscal year 2014.

By C. Todd Lopez

Source : US Army

—————————————————-

Solar Power on the Battlefield

In the past year the U.S. Department of Defense has spent more than $20 billion on energy and has consumed over five billion gallons of oil according to an article released by the Solar Energy Industries Association (SEIA) (1). The military has redirected its focus towards renewable energy, specifically solar power, in an effort to combat rising energy costs, potential energy supply disruptions and the need for more secure and clean energy generation and distribution. The DOD has recognized the proven effectiveness of alternative energy and is committed to implementing large amounts of renewable energy sources into our armed forces.

In the past year the U.S. Department of Defense has spent more than $20 billion on energy and has consumed over five billion gallons of oil according to an article released by the Solar Energy Industries Association (SEIA) (1). The military has redirected its focus towards renewable energy, specifically solar power, in an effort to combat rising energy costs, potential energy supply disruptions and the need for more secure and clean energy generation and distribution. The DOD has recognized the proven effectiveness of alternative energy and is committed to implementing large amounts of renewable energy sources into our armed forces.

Title 10 USC 2911 of the DOD mandates that 25 percent of total facility energy consumption comes from renewable energy sources by 2025. As stated in the SEIA article, “The Navy, Army and Air Force have each implemented aggressive plans that have put the U.S. military on a path to significantly expand its use of clean, renewable solar energy.” Many of these plans rely mostly on solar power. For example, the U.S. Air Force plans for PV to account for over 70 percent of its renewable energy capacity to be added from 2012 to 2017.

Already, the military has powered bases with large, centralized utility-scale projects. They’ve also applied smaller, distributed-generation (DG) systems to energize buildings and homes, as well as portable solar systems to provide energy on battlefields. These uses of solar along with many others allow the military to rely less on traditional generators which tend to be targets for enemy fire. As a result, the need for expensive, and not to mention dangerous, fuel resupply missions is lessened.

“As of early 2013, there are more than 130 megawatts (MW) of solar photovoltaic (PV) energy systems powering Navy, Army and Air Force bases in at least 31 states and the District of Columbia. Combined, these installations provide enough clean energy to power 22,000 American homes. These solar totals do not include installations at bases abroad, on the battlefield or at any classified locations” – SEIA.

Solar has and will continue to provide the military with operational energy, which improves the “tactical edge” and security of our armed forces. Solar technology is advancing every day and because of that, so is the protection of the individuals who fight for our country.

—————————————————–

ll-Terrain Vehicle (S-ATV) and the autonomous, flexible Robotic Combat Vehicle (RCV).

ll-Terrain Vehicle (S-ATV) and the autonomous, flexible Robotic Combat Vehicle (RCV).